Chinese exports to the United States spiked by more than 15% year-on-year in December, on the back of a rush to export ahead of widely expected tariff hikes under the incoming Trump administration.

Chinese exports to the U.S. rose by 15.6% in December compared to the same time last year, while exports to the European Union rose by 8.8%. Outbound shipments to Southeast Asia rose by nearly 19%.

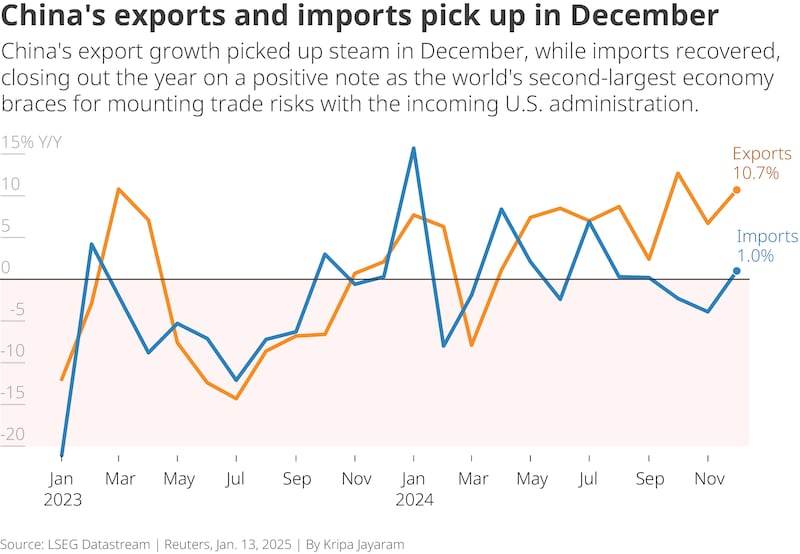

Total exports rose by 10.7% in dollar terms, compared with the same month in 2023, the General Administration of Customs reported on Jan. 13, while imports rose by just 1%.

Xi has said he’s ready to work with the Trump administration, but has also warned that both countries stand to “lose from confrontation,” as Trump announced plans to impose tariffs of at least 60% on Chinese imports.

China’s exports are likely to remain strong in the near-term as businesses try to “front-run” potentially higher tariffs, analysts said.

“The external environment is more complex right now, with more uncertainty and unstable factors,” the administration’s deputy director Wang Lingjun told a news conference in Beijing.

“There is increased impact from geopolitical factors, unilateralism and protectionism,” Wang said, in a reference to President-elect Donald Trump’s pledge to impose tariffs of 60% on Chinese goods across the board.

“There are severe challenges to stable foreign trade growth,” he added.

Companies face pressure

Chen Soong-hsing, adjunct professor at the Institute of National Development at Taiwan’s Chinese Culture University, said Chinese exports surged in the second half of 2024, as companies rushed to get their goods into the U.S. before Trump’s inauguration on Jan. 20.

“The Trump administration is about to take office, and the United States may implement new tariffs,” Chen said. “There is also the psychological expectation that Congress will pass a bill canceling China’s normal trading status.”

Rep. John Moolenaar, chair of the House Select Committee on the Chinese Communist Party, introduced the Restoring Trade Fairness Act to the House in November, seeking to suspend China’s Permanent Normal Trade Relations. A similar bill was introduced in the Senate earlier in the year by Senators Tom Cotton, Marco Rubio and Josh Hawley.

Yet prices charged by exporters have remained low, Chen said.

“[This] shows that many Chinese companies are still facing pressure to cut prices and destock,” he said.

“Trade front-loading became more visible in December as a result of both Chinese New Year effects and Donald Trump’s inauguration,” said Xu Tianchen, senior economist at the Economist Intelligence Unit, told Reuters, in a reference to the Lunar New Year, which runs from Jan. 28 to Feb. 4.

“Import growth could be underpinned by stockpiling of commodities like copper and iron ore, as part of (China’s) ‘buy low’ strategy,” he added.

RELATED STORIES

Xi Jinping’s talk of ‘rainbows’ belies simmering public anger over China’s economy

Never mind the overcapacity, have some dim sum!

China expecting harder times after Trump victory

China’s cumulative trade surplus with the United States will be US$270.4 billion in 2024, according to November figures from the U.S. Census Bureau, compared with US$279.1 billion for the whole of 2023, and US$382.1 billion in 2022.

Auto exports

Meanwhile, China’s auto exports are estimated to slow notably this year after holding the export crown for a second year in 2024, with no growth predicted for electric vehicle exports, Reuters reported on Jan. 9.

With car exports up 25% to 4.8 million units, according to data from the China Passenger Car Association data, China probably ranked as the world’s largest auto exporter ahead of Japan for a second consecutive year in 2024 despite additional tariffs on China-made electric vehicles the European Union introduced in late October, the report said.

“Outbound shipments are likely to stay resilient in the near-term, supported by further gains in global market share thanks to a weak real effective exchange rate,” the Associated Press quoted a note from Zichun Huang of Capital Economics as saying.

But exports will likely weaken later in the year if Trump follows through on his threat to impose tariffs, Huang said.

Chen said yuan depreciation could help exports, but that the People’s Bank of China has been issuing bonds in Hong Kong to mop up some of the “hot” speculative funds and cracking down on short selling of the yuan, to keep the currency within its desired range.

“Future China-U.S. trade negotiations will involve exchange rate issues,” Chen told Radio Free Asia. “During the negotiations, the United States will be concerned about whether China is expanding exports through deliberate devaluation and unfair subsidies.”

“This may prompt China to slow down relevant policy adjustments to avoid greater impact on external export competition,” he said, adding that yuan depreciation also puts pressure on the currencies of other export-oriented economies in Asia like Taiwan, South Korea and Japan.

Manufacturing capacity

The U.S. will also continue to press China on concerns of excess manufacturing capacity, accusing Beijing of " flooding" markets by heavily subsidizing products like electric vehicles, lithium-ion batteries and solar panels to revive economic and export growth, according to Chen.

Beijing has repeatedly denied the claims.

“There is no China overcapacity issue — that is a false proposition,” Wang Lingjun told the Jan. 13 news conference in Beijing.

Chung Chih-tung, assistant researcher at the Taiwan Institute for National Defense and Security Research, said China’s economy has been largely created and stratified by government policy, which has plowed huge resources into specific industries, particularly green energy and electric vehicles, as well as cutting-edge technology like artificial intelligence and semiconductors.

“Such a system also exposes them to downside risks, such as the failure to achieve their goals despite huge investments in semiconductors,” Chung said. “This is due to corruption in the system, and errors in policy.”

Translated by Luisetta Mudie. Edited by Roseanne Gerin.