As Europe reels from financial turmoil and the U.S. economic recovery falters, storm clouds are gathering over China and most of Asia.

Both the International Monetary Fund and the Asian Development Bank have slashed growth rates for the region, which is beginning to experience a slowdown in exports to the advanced economies.

Soaring inflation—led by the region's biggest casualty, Vietnam, suffering from a whopping 23 percent jump in consumer prices—is also taking a toll on economies that have tightened monetary policy to tame rising food costs.

Compounding the economic slowdown are concerns over financial instability stemming mainly from China's mountain of debt—its stock of domestic loans has reached a colossal 173 percent of the country's Gross Domestic Product (GDP)—that experts say risks crippling its banking system.

"China has an unusually high level of gross debt," the IMF warned in a report this week, noting that the country's post-2008 credit boom has "left a legacy of doubtful loans, especially to local government entities," even though the massive lending helped the economy expand rapidly.

Loan growth was slowed by Beijing's five-time interest rate increase over the past year to contain inflation, but other forms of credit appeared to have surged.

A long-running real estate boom in China has also added another layer of risk. Property prices have risen 60 percent since end-2006 with many newly built units still unoccupied.

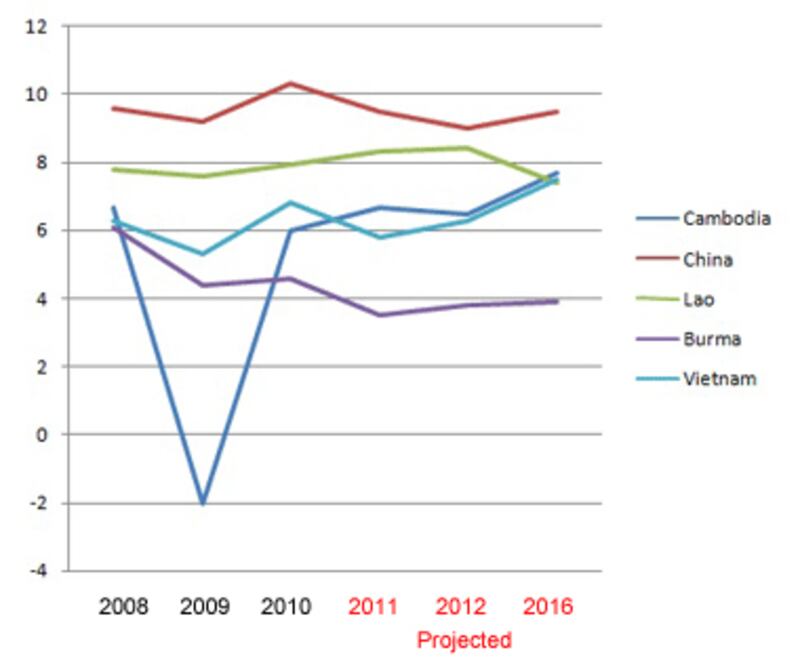

"Against this backdrop, financial markets have recently signaled growing concerns," the IMF said, clipping China's annual growth rate forecast to 9.5 percent in 2011 and 9.0 percent next year from 10.3 percent last year.

Growth rates

Some policymakers are warning that growth rates will slow sharply in the coming years to perhaps six to eight percent.

"Although investors have maintained a generally favorable outlook for the Chinese economy, many worry that the ongoing policy tightening might expose vulnerabilities related to the property and credit booms," the IMF said.

Bigger mess

Experts say that if the United States and Europe slip into their second recession in three years, trade-driven China will be in a bigger mess.

"The odds are about evenly balanced between a soft and hard landing, with global economic conditions being the wild card," said Eswar Prasad, a former head of IMF's China division.

Now an economics professor at Cornell University, Prasad sees signs of "increasing domestic policy tensions" in China as concerns about high inflation square off against the desire to maintain strong domestic growth.

A double dip recession in the West would be a "serious problem for China because trade linkages remain very important, even though China is relatively insulated financially," said Pieter Bottelier, a former chief of the World Bank's resident mission in Beijing.

The European Union is China’s largest trading partner, followed by the United States.

In fact, the European and American financial crises have placed Asia's banking system on alert over fears of a sudden exodus of capital from emerging markets, which have been attracting money since recession gripped the West in 2008.

"[E]merging markets face a potential global shock that could lead to a reversal of capital flows and a drop in economic growth," warned Jose Vinals, Director of the IMF’s Monetary and Capital Markets Department.

"Our analysis shows that the impact on emerging market banks could be substantial and thus warrants a further buildup of capital buffers in the banking system."

Asian markets are already feeling the impact of the eurozone debt crisis in particular, with regional currencies and stocks sliding and tens of billions of dollars exiting the region, according to market reports.

Intraregional trade

Any economic blow to China will impact many of its neighbors, as China's role in Asian regional trade has become increasingly important. A rising share of its imports come from within the region.

Aside from China, the IMF shaved growth prospects in India to 7.8 percent this year and 7.5 percent in 2012 from 10.1 percent in 2010.

The Fund said Japan's economy, recovering from a devastating earthquake, would shrink 0.5 percent in 2011 but would hit 2.3 percent in 2012.

Vietnam’s growth was cut to 5.8 percent this year from 6.8 percent in 2010 but is seen to rise again in 2012 to 6.3 percent.

The Southeast Asian nation is battling a nearly three-year high inflation rate. Its currency, the dong, has weakened about one percent in the past month against the dollar even after it was devalued four times.

The Asian Development Bank this month trimmed its growth forecast slightly to 7.5 percent for both this year and next for 45 developing or newly industrializing Asian countries, excluding Japan.

It warned that the slowdown in demand from the United States and Europe "continues to cast a cloud" over Asia, with export growth easing substantially in the second quarter in China and other leading economies.

"The main headwinds to the region's growth come from faltering prospects in the major industrial economies," the Manila-based lender said in a report.