China is trying to dig out from a mountain of corporate debt, but the tools it has chosen may have little effect.

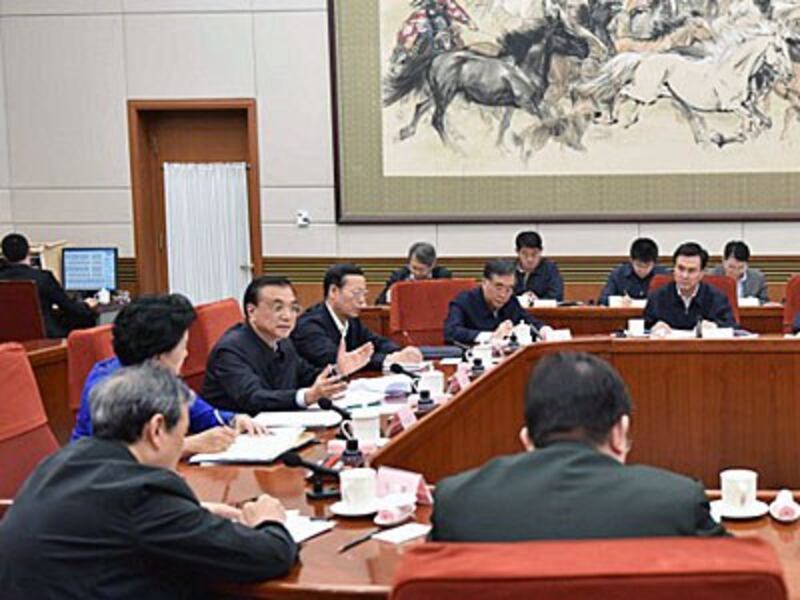

On Oct. 10, China's cabinet-level State Council issued guidelines for a program to ease the economy's debt burden by promoting investment in shares of troubled companies.

The debt-for-equity swap plan follows warnings from international financial institutions that China may face a crisis brought on by excessive lending and U.S. $18 trillion (121 trillion yuan) in corporate debt.

The corporate debt load has climbed to 169 percent of China's gross domestic product, according to data from the Swiss-based Bank for International Settlements (BIS). But that is only part of China's total debt, which now stands at an estimated 255 percent of GDP.

The warnings serve as a reminder that the government's credit-fueled attempts to slow China's slide in GDP growth have been accompanied by a rise in bad debt and problem loans.

In a September report, the BIS said that China runs the risk of a banking crisis in the next three years.

On Oct. 1, the International Monetary Fund hailed the inclusion of China's yuan in its basket of currencies for Special Drawing Rights, calling it a "historic milestone" for the country that marks its economic progress.

Yet, three days later, the IMF warned in its updated World Economic Outlook that "the economy's dependence on credit is increasing at a dangerous pace, intermediated through an increasingly opaque and complex financial sector."

"Dangerous" is a term rarely used in IMF parlance. For a country just admitted to the world's elite currency club, it may be considered extraordinary.

"The high and rising credit dependence reflects a combination of factors—the pursuit of unsustainably high growth targets, efforts to prop up nonviable state-owned enterprises to preserve employment ... and opportunistic lending by financial intermediaries in the belief that all debt is implicitly guaranteed by the government," the IMF said.

Masking the problems

China's new debt-for-equity swaps could have a marginal effect on the debt numbers, but it may only mask the problems by increasing the shares of distressed companies held by state banks.

To limit the risk, the government has barred chronic debtors and the most troubled "zombie" companies from taking part in share swaps.

"The program is open only to promising companies with short-term difficulties," said Lian Weiliang, deputy director of the National Development and Reform Commission (NDRC) planning agency.

"Loss-making zombie companies will be strictly banned," Lian said, according to the official English-language China Daily.

State media have stressed the positive aspects of the swap plan.

"This kind of swap is generally believed to benefit both banks and struggling companies," said the official Xinhua news agency. "They reduce the pressure on companies and free up bank balance sheets, releasing capital for investment."

But the exclusion of seriously distressed enterprises has raised doubts that the plan will do much to shrink China's mountain of debt.

"If the program only helps the salvageable companies, then it will do little to solve the problem of the hard cases where most of the debt is concentrated," said The Wall Street Journal in its "Heard on the Street" column.

"There are no policy panaceas for China's debt problem—just placebos," the paper said.

Although details remain sketchy, the government has taken pains to distinguish the plan from a previous swap program launched in the 1990s.

"The government will play a complementary role only," China Daily quoted the guidelines as saying. "It will not be responsible for choosing which companies are qualified for the program and won't bear the losses during the swap process."

Capping debt ratios

Despite the hands-off approach, Lian suggested there could be a cap on the debt ratios of firms participating in swap deals, Hong Kong's daily The Standard reported.

Last week, the State Council also agreed to establish a "joint meeting system" of 17 ministries and commissions to reduce corporate leverage and organize pilot deals for debt- to-equity swaps, the National Business Daily reported.

The process suggests that government bureaucracy will be deeply involved despite the insistence that it will play only a "complementary role."

The NDRC has offered no estimate of the size of the program or its target for participation.

"This round of the debt-for-equity conversion program is 'market-oriented,' and there is no predetermined scale of the plan," said NDRC spokesman Zhao Chenxin in a Xinhua report.

The emphasis on a market-driven process and the lack of government guarantees appear to be responses to concerns raised by the IMF.

In a China Daily interview, the IMF's senior resident representative for China, Alfred Schipke, said the guidelines are a sign that the government "has realized the risks posed by rising debt issues."

But Schipke also warned that "the challenge lies in the implementation process when it comes to local levels," the paper said.

The State Council sought to downplay expectations of a big wave of swaps by banks, noting that debts must first be transferred to an "execution agency" for conversion.

Reports named "asset managers, insurers, state-owned asset firms, as well as qualified units at banks" as agencies that would organize swap deals with investor participation.

Role of agencies and investors

What if any role the agencies and investors would have in the management of the companies remains unclear.

Private investment interest may prove to be a particularly weak point in the plan.

Growth of private investment in fixed assets has been weak since the start of the year, reaching a rate of just 2.5 percent for the first nine months. The government's stance against backing for debt swaps may do little to encourage private investment in new shares.

"The government definitely won't pick up the tab for any losses," Lian said, according to a Wall Street Journal report.

With or without the intermediaries of "execution agencies," the burdens of debt and potential share losses are likely to fall on the banks.

China's lending spree has already raised international concerns for bank risks.

In September, yuan-denominated loans jumped 29 percent from a month earlier to 1.22 trillion yuan (U.S. $181 billion), largely on mortgage lending, according to the People's Bank of China (PBOC).

The surge, after more than doubling in August, pushed new loans in the first nine months to a record 10.16 trillion yuan (U.S. $1.51 trillion), Reuters said.

On Oct. 11, analysts at S&P Global Market Intelligence warned that rising corporate debts could force China to recapitalize its banks with an infusion of U.S. $1.7 trillion (11.4 trillion yuan) to cover bad loans.

In the S&P survey of 200 top companies, 70 percent were state-owned enterprises (SOEs), accounting for U.S. $2.8 trillion (18.8 trillion yuan) of debt, Reuters said.

Gary Hufbauer, senior fellow at the Peterson Institute for International Economics in Washington, said the debt-for-equity swaps are likely to address only a small part of China's problem.

"I think the problem is so large that what they're going to do will be somewhat on the cosmetic side," said Hufbauer. "I would regard this as a gesture to buy time, basically," he said.

Too large to convert

One concern is that corporate debt is too large to convert into shares on a large scale without running the risk of diluting share values and crashing the stock market, Hufbauer said.

Typically, debt-for-equity swaps lead to a realization of losses as part of the process.

In China's case, state banks have resisted recognizing problem loans to SOEs as non-performing for years, keeping the PBOC's official bad loan ratio relatively low.

In the first nine months of the year, the liabilities of China's SOEs rose 9.9 percent from a year earlier to 85.3 trillion yuan (U.S. $12.6 trillion), according to Ministry of Finance data.

"Maybe at the end of the day, a lot of this has to be just written off," said Hufbauer. "That's not going to be pleasant either, and naturally, every attempt will be made to postpone that unhappy day."

In September, the government approved the first of the new round of debt-equity swaps, allowing state-owned metals company Sinosteel to trade 27 billion yuan (U.S. $4 billion) of its debt for equity convertible bonds.

The bonds can be exchanged for shares in the company at a later date, Caixin magazine and Reuters reported. The deal is said to cover nearly half of Sinosteel's debt owed directly to financial institutions.

The plan includes an "initial investment" of 10 billion yuan (U.S. $1.5 billion) from the government's State-Owned Assets Supervision and Administration Commission (SASAC), Caixin said.