China’s search for new energy sources has set back the cause of human rights in Africa, advocates say, but some analysts argue that China’s investment is just part of the worldwide competition for oil.

Over the last three years, China’s surge in oil imports has fueled trade and investment in regions ranging from the Middle East to Central Asia and South America. But its energy expansion has proved most controversial in Africa, where China has been blamed for channeling funds into corrupt governments and civil wars.

...Those arms are purchased with the proceeds that Sudan receives from its oil sales to China.

With oil imports soaring over 87 percent since 2002 to 2.6 million barrels daily last year, China has relied heavily on Africa. In the first 11 months of last year, China bought more than 765,000 barrels per day, or 30 percent of its imports, from African countries, according to Chinese customs data.

Beyond oil, China has signaled the importance of Africa to its foreign policy and global strategies. In January, the Chinese government issued a lengthy African policy paper to coincide with a week-long tour of six African countries by Chinese Foreign Minister Li Zhaoxing.

Taiwan may be an issue

The paper noted that 47 out of 53 African countries have established relations with Beijing. The figures suggest that China sees Africa as critical not only for trade but also for its struggle to block world recognition of arch-rival Taiwan.

While China imports oil from nine countries across the continent, its two largest sources—Sudan and Angola—have raised the biggest concerns. Although the two cases are very different, human rights advocates see a common problem.

Kenneth Roth, executive director of Human Rights Watch, told Radio Free Asia that China has shown little regard for how the revenues from its investments and oil imports are used in Africa.

“The problem in general with Chinese investments is that the Chinese government has an explicit philosophy of paying no attention to a government’s human rights record,” Roth said.

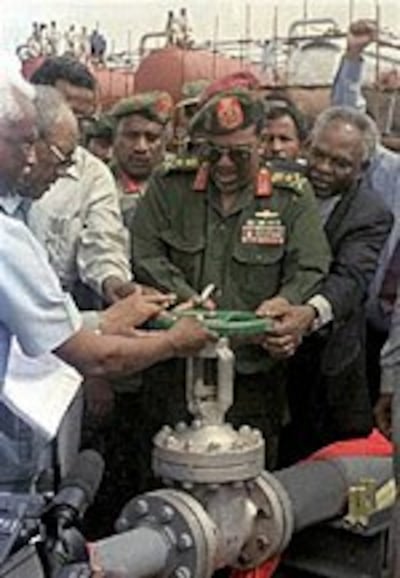

In the case of Sudan, the China National Petroleum Corporation (CNPC) has been involved as a major investor since 1996, when it joined with other foreign partners to form the Greater Nile Petroleum Operating Company.

The group developed oilfields and a pipeline to begin exports in 1999 despite Sudan’s long civil war.

Rights groups charge that CNPC’s investment helped Khartoum prolong the north-south war in which some 2 million people have died since 1983.

More killing in Sudan

While a peace treaty was signed in 2004, ethnic cleansing has continued in the region of Darfur, killing an estimated 180,000 civilians and displacing some 2 million more.

Roth said the bloodshed in Sudan should have kept CNPC from supporting the government with investment and oil revenues.

Joshua Eisenman, a fellow in Asia studies at the American Foreign Policy Council in Washington, said that China has also supplied Sudan with large quantities of arms. “And those arms are purchased with the proceeds that Sudan receives from its oil sales to China.”

“In the case of Sudan,” said Eisenman, “a country torn apart by war for decades now, literally throwing ammunition into that kind of a fight is irresponsible.”

Philip Andrews-Speed, a China energy expert at Scotland’s University of Dundee in Edinburgh, said that one reason for China’s willingness to make unpopular investments may be its rapid growth and its need to catch up with Western competitors.

In this competition for investment opportunities around the world, he said, China has sometimes been driven to pay more.

“It is definitely having to catch up,” Andrews-Speed said. “In most parts of the world where the biggest opportunities are, the Western majors are already there.”

This race for resources may have been a factor in China’s oil investment in Angola, which has stirred controversy of a different sort.

In October 2004, China’s Sinopec oil company won a competition with India for a share in a rich offshore oilfield after Beijing promised Angola a $2 billion soft loan, according to analysis by the Energy Information Administration of the U.S. Department of Energy.

The loan has drawn attention because of Angola’s poor record in accounting for funds following its own 27-year civil war.

Discrepancies cited

In a 2004 report, Human Rights Watch cited an International Monetary Fund (IMF) study of “discrepancies” in the government’s accounts. The report concluded that over $4.2 billion had gone missing between 1997 and 2002, said executive director Kenneth Roth.

“This is roughly the equivalent of everything that the Angolan government spent on social services,” Roth said.

The IMF has suspended further loans until the Angolan government agrees to adopt transparency practices and root out corruption.

Roth said that China’s loan has worked against that effort, even though it is supposed to be spent on civic projects like hospitals and schools.

Roth said the common thread in China’s conduct in both Sudan and Angola is that it shows little regard for public welfare.

“I don’t think that’s in the interest of Chinese leaders. I don’t think that’s the reputation they want to have.”

Original reporting by Michael Lelyveld. Edited and produced for the Web by Richard Finney and Sarah Jackson-Han.