January brought a fresh gust of rumors about the whereabouts of Nguyen Phu Trong, the Communist Party of Vietnam general secretary. He hadn't been seen in public for a few weeks and failed to meet with the visiting president of Indonesia, leading some commentators to speculate that his health was deteriorating once again.

We had been here in 2019 when it was rumored – accurately, it turned out – that Trong had suffered a stroke while on a visit down south. This time around, Trong showed up again rather quickly, delivering a speech to the National Assembly on January 15.

But rumors of the 79 year-old’s failing health are a reminder of his and the country’s frailty.

Given that party chiefs tend to rule for two five-year terms, we can assume that the next general-secretary, if voted in at the next Communist Party of Vietnam, or CPV, National Congress in 2026 and if Trong does actually retire then, will rule until 2036.

It is not overly dramatic to say that the next party chief will govern during the most consequential decade of Vietnam’s development.

Not least, that person is likely to enter office facing even more uncertain world politics.

One uncertainty is China, whose economy is in a terrible state and which is set to experience perhaps the worst demographic crisis of any country in known history.

The other is a retreating America. The great debate in the United States right now is whether to maintain its post-1945 interest in world affairs or to descend into nationalism and protectionism.

If Washington chooses the latter – and Donald Trump’s possible re-election later this year would be an indication of that – the globalization we’ve known since 1945 that has depended on U.S. security guarantees, not least to keep the seas safe for world trade, could collapse.

Vietnam has arguably been one of the biggest beneficiaries of globalization – perhaps second only to China in recent decades. More to the point, China and the United States combined account for 46 percent of Vietnam's exports and 40 percent of its imports.

Demographic time bomb

Hanoi can do little to rectify China’s troubled economy or dispel America's isolationist tendencies. But it can clean its own house.

The most existential concern, as framed by a headline in the state-run press last year, is its "demographic time bomb." Thailand is set to lose 10 million people of working age by 2050, about a quarter of its current workforce. China, based on conservative estimates, will lose 217 million workers, down from 984 million today.

Vietnam, thanks to its citizens having so many children in the 1990s, will only see its working-age population dip by around 253,000 people by 2050, from 67.6 million now – a 0.3 percent fall. The workforce will have passed its peak by the mid-2030s.

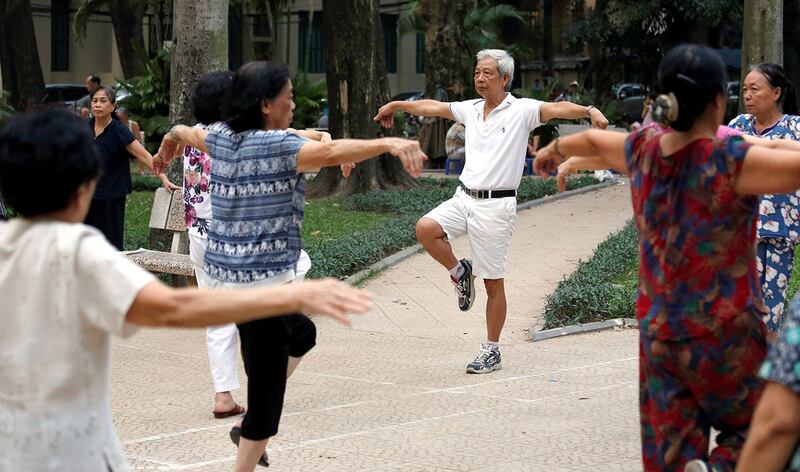

Instead, Vietnam appears set to suffer the problem of too many retirees. Vietnam became an “aging” society in 2011, when 7 percent of its population was aged over 65. It will become an “aged” society, when that demographic is more than 14 percent of the population, in 2034.

Vietnam will be the fourth "aged" society in Southeast Asia, after Singapore, Thailand and Brunei. The percentage of people over 65, those who don't work and are net extractors of state money, will double between now and 2050, from 10 percent to 20 percent.

In fact, people over 60 will go from 14.7 to 26.5 percent of the population over this timeframe. That's the figure to bear in mind since Vietnam's retirement age for men will be 62 in 2028 and 60 for women in 2035.

Moreover, the proportion of retirees will probably be higher than 26 percent of the population since women, who retire earlier, outnumber men by the time they’re 60 years old. So it’s possible that Vietnam is looking at around a fifth of its population in retirement by 2030 and nearly a third by 2050.

Unlike Thailand and China, whose demographic future is dire, more so than some analysts think, Vietnam won't see a declining workforce at the same time as an increase in retirees, so it won't be left trying to scrape less money from fewer workers for greater welfare payments to more retirees.

However, Vietnam is starting from a lower wealth base. If its GDP per capita doubles between now and 2034, it would still be on par with Thailand’s GDP per capita today. If it triples, it will be on par with today’s Malaysia, which won’t become “aged” until 2042.

Tough decisions won’t wait

Vietnam risks becoming old before it becomes rich, unless, that is, it can turbocharge its economy over the coming decade and half. According to the World Bank, Vietnam has until 2042 before its "demographic window of opportunity will close."

The state will have to find vastly more money for its retirees, sapping funds that could be invested in infrastructure and education.

Spending on education has already fallen from around 18 percent of government expenditure in the early 2010s to around 15 percent. Infrastructure spending has been criminally misused. Just look at the badly managed Ho Chi Minh City metro project.

Currently, average social insurance payments are just $240 per month, a little over two-thirds of workers' average income. A lengthy World Bank report noted that "Countries with old-age dependency ratios equal to Vietnam's projected level in 2035 typically spend 8-9 percent of GDP on public pensions, well above the 2-3 percent that Vietnam has spent over the past decade".

By today’s GDP, that means the Vietnamese state will need to find something in the range of $18-21 billion annually just for pensions within a decade. That’s not counting the additional financial strain of an aged society on the government and on households for health services.

Demographics ought to focus minds in Hanoi on the fact that the good times won’t last forever, and the population dividend Vietnam has been gifted since the 1990s will be over quite soon.

Things have to change now. In 2021, for instance, labor productivity was valued at just US$10.22 per hour, compared to US$13.53 in China and US$15.06 in Thailand.

Vietnamese companies have barely any international footprint at the moment. More work is needed to incorporate Vietnam’s economy into supply chains in Cambodia and Laos, both of which will see their workforces increase in size by 2050.

Private consumption as a percentage of GDP has fallen since 2015, making Vietnam more dependent on exports. That's risky in this era of deglobalization. Then there are issues over whether upriver damming on the Mekong will decimate Vietnam's food production – thus increasing imports in the future – and how climate change will impact the economy.

This demographic “time bomb” won’t quite explode during the tenure of the next party chief assuming he serves two terms until 2036, but preparations for what to do when it detonates will certainly come on his watch.

Although, on a positive note, the economy should return to around a 6 percent growth rate by 2026, according to the World Bank, the next party chief will still have difficult decisions to make.

Trong's signature anti-corruption campaign has improved the CPV's image but it has massively sapped economic development. His successor, who will be selected because he is trusted to continue the campaign, will be pressured to end it.

Administrative reforms are overdue, but these will weaken the party’s grip on power. The government will need to massively increase tax collection, not least to pay for the booming retirees, but this will be unpopular and difficult. And if the U.S. does decide on isolationism and China becomes more chaotic, diplomacy will have to be performed on a knife’s edge.

Small wonder, then, that the CPV has dallied on choosing Trong's successor.

David Hutt is a research fellow at the Central European Institute of Asian Studies (CEIAS) and the Southeast Asia Columnist at the Diplomat. As a journalist, he has covered Southeast Asian politics since 2014. The views expressed here are his own and do not reflect the position of RFA.