Lauded by Beijing as a model business, Country Garden, a 31-year-old too-big-to-fail property developer, is showing signs of succumbing to the same cash-strapped suffocation that has blanketed China’s once vibrant real estate sector.

On Monday, Country Garden Holdings Co. failed to pay U.S.$22.5 million in interest due on debt securities with a total value of $1 billion.

"Prices of the two bonds, which were scheduled to mature in 2026 and 2030, plunged to less than 8 cents on the dollar, according to Tradeweb," said one report. "Such levels indicate that investors are expecting the company to default."

When bonds trade far below their face value, traders interpret it as meaning the bond holders don’t expect to get all their money back.

Country Garden still has a 30-day grace period to pay its coupons, before its bondholders can call it as in default, but its Hong Kong-listed shares fell 14% on Tuesday amid a broader selloff of China property stock.

A company spokesperson told the Wall Street Journal that the company was unable to make its interest payments due to deteriorating sales and a liquidity crunch.

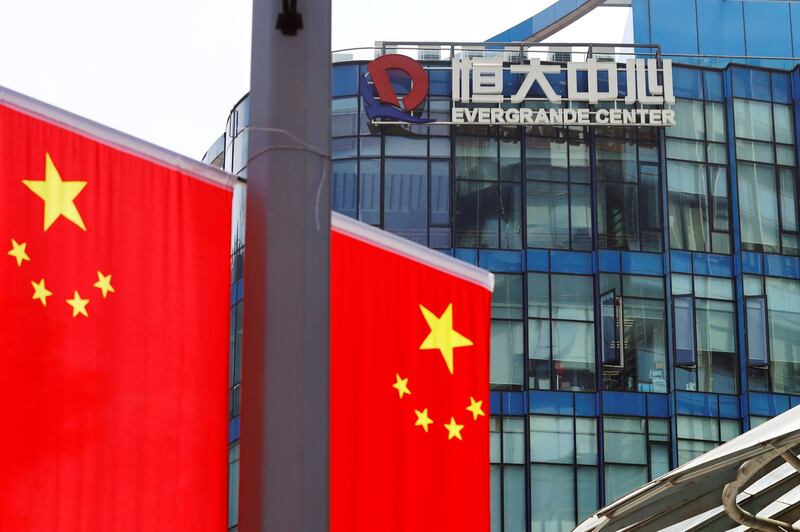

In late 2021, property developer China Evergrande collapsed under accumulated debts, sending the global economy briefly into a spiral and leading to protests in China by would-be homeowners who claimed to have been defrauded on off-plan homes that were never built or completed.

After a short-lived bounce back early this year, China's property market, in line with consumer spending in general, has drifted back into the doldrums. Along with Evergrande, major developers such as Sunac China Holdings, have defaulted, sending the entire real estate market into a deep slump.

Fortunes at stake

The fortune of Yang Huiyan, the chair of Country Garden and formerly the richest woman in Asia, has slumped by 84% since June 2021 – including a tumble of 8.2% on Tuesday alone, according to the Bloomberg Billionaires Index.

The billionaire’s fortune has been whittled away from a peak of U.S.$28.6 billion to U.S.$5.5 billion today – the “biggest decline among the ultra-rich tracked by Bloomberg’s wealth index over that period.”

But the real threat, say China-based analysts, is an official default by Country Garden, which could be a further nail in the coffin of a sector that has traditionally driven some 25% of China’s economic activity.

Wide-scale debt default

Wang Guochen, an assistant researcher at the First Research Division of the Chung Hua Institute for Economic Research, told RFA Mandarin in an interview on Tuesday that, according to a review by his institute of 100 real estate companies in China, “all of them are more or less involved in debt default.”

The buzz term, said Wang, is “lack of confidence.” He added that people aren’t buying like they used to due to high levels of unemployment and tightened household incomes.

“How can you talk about buying a house if your household income is reduced and you are worried about unemployment?” he said.

“As for the developers, they build homes that nobody wants and then find themselves unable to service their debts.”

Widely-read Chinese blogger “Public Relations Circle” wrote that the problem for Country Garden is that the developer is focused on third- and fourth-tier cities, which means it operates on a greater scale than most of its rivals and likely on tighter margins.

“It’s said that Country Garden has more than 3,000 projects, while Evergrande only has around 700, and that means a lot more undelivered properties than even Evergrande is facing,” the blogger wrote.

Wang Guochen compares China’s response to the real estate slump to a “bomb defusal” mission in a movie.

Any slight misstep could prematurely trigger an explosion, which potentially leads to paralysis, said Wang.

“In the case of Evergrande, state-owned enterprises didn’t take over and the government didn’t write off Evergrande’s bad debts. In the meantime, it and other property developers like Country Garden continued making speculative housing investments.”

Real estate accounts for a quarter of China’s GDP, said Wang, adding that it was so important that it was not simply crucial to stimulating the economy but to stabilizing the economy and avoiding widespread public discontent.

“The goal should be to avoid both financial collapse and stabilize housing prices so as to not fan the flames of public discontent,” said Wang.

Edited by Mike Firn and Taejun Kang.