China's economy showed stronger factory output and retail sales, but is still struggling with "difficulties and challenges," the government said on Friday.

Industrial output rose by 6.6% in November from a year ago while retail sales jumped 10.1%. However, analysts told Bloomberg they were expecting retail sales to rebound by around 12.5% from a low base the previous year due to COVID-19 restrictions across the country.

The figures came after a forecast from the World Bank on Thursday that this year's 5.2% annual GDP growth rate will slow to 4.5% next year and to 4.3% in 2025.

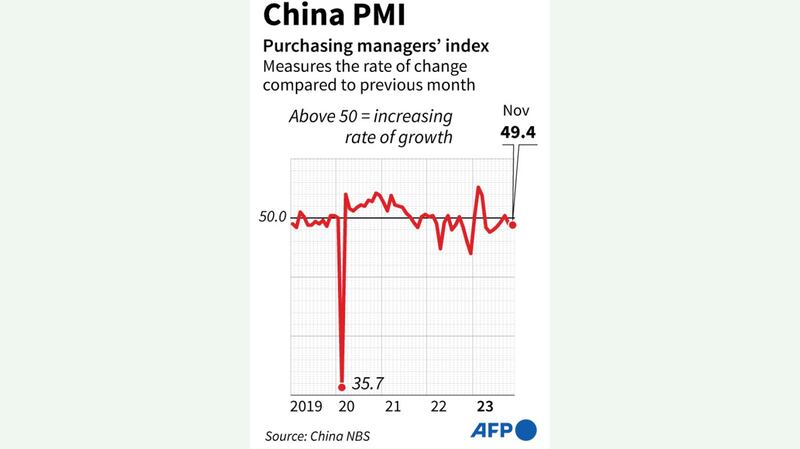

A survey of factory purchasing managers known as the purchasing manager index showed a slightly bigger contraction in factory activity compared with October, something an official spokesperson partly blamed on a lull following holiday production rushes.

"[But] at the same time there is insufficient market demand,” National Bureau of Statistics spokesperson Liu Aihua told a news briefing in Beijing.

"Looking to the future, the internal and external environment facing our country’s development is still complex and severe," Liu said in comments reported by the Associated Press. "To further promote economic recovery, we need to overcome some difficulties and challenges."

"Difficulties and challenges" is an official phrase lifted from the ruling Chinese Communist Party's recent Central Economic Work Conference in Beijing, and refers to a collapsed property bubble, weak domestic demand, crippling government debt and dwindling investor confidence, among other things.

‘Mixed picture’

Analysts at Goldman Sachs said November's figures "painted a mixed picture" with "still-subdued private demand and weaker-than-expected CPI inflation," according to a note cited by the AP.

China's national producer price index fell by 3.0% year-on-year and 0.3% month-on-month, its 14th consecutive month of decline, while consumer prices dropped by 0.5% year-on-year and 0.5% month-on-month.

China has recorded a negative producer price index a number of times since 2009, and each dip into negative territory has been accompanied with a decline in private investment, according to Li Xunlei, chief economist of Zhongtai Securities.

"This shows that China may have a long-term problem of insufficient demand," Li wrote in a recent commentary for the Chinese Communist Party-backed Ta Kung Pao newspaper. "Expanding domestic demand is a long-term strategy, in which promoting consumption is far more important than expanding investment."

His words echoed those of Chinese leader Xi Jinping, whose economic policy revolves around top-down party control of financial markets and the expansion of state-owned enterprises, who sees the expansion of domestic demand and consumption as the key to post-lockdown economic recovery.

Yellen comments

U.S. Treasury Secretary Janet Yellen warned on Thursday that Xi's economic policy, including raids on foreign companies, could discourage foreign investors and affect economic growth.

"Too strong a role for state-owned enterprises can choke growth, and an excessive role for the security apparatus can dissuade investment," Yellen told the US-China Business Council's 50th anniversary dinner in Washington.

She added that the policy was a "barrier to access" for foreign companies and warned that the current emphasis on national security concerns was also putting American firms off.

A larger proportion of companies have said they plan to move some operations out of China in 2023 than in any year since 2016, according to a recent US-China Business Council member survey cited by Yellen.

U.S.-based current affairs commentator Tang Jingyuan said much of China's economic recovery is being hampered by plummeting confidence caused by government interference.

"Xi Jinping ... uses political methods to intervene in economic life, including locking down cities over three years under the zero-COVID policy," Tang told Radio Free Asia in a recent interview regarding the Central Economic Work Conference.

"He has continued to intensify his efforts to control economic life at the political level ... but economic laws won't obey the party's command," he said.

"The two main reasons that they haven't managed to rescue the Chinese economy so far are the bankruptcy of the Chinese government's credibility and the collapse of confidence in Xi Jinping," Tang said.

‘Black hole’ of debt

Wu Se-chih, researcher at Taiwan's Cross-Strait Policy Association, said there is also a "black hole" of local government debt that was once leveraged against a booming property sector.

Meanwhile, the government now lacks the financial resources to engage in a nationwide infrastructure spending spree to boost growth, as it has habitually done since the 1990s.

"The real [debt] problems haven't been resolved ... so we need to consider the government's financial capacity [when it comes to] public infrastructure construction, a method commonly used by the Chinese Communist Party since reform and opening up began [in 1979]," Wu said.

There is scant sign of a rebound in the property sector for now. Home prices fell month-on-month in major Chinese cities in November.

And while fixed-asset investment -- an indicator of urban infrastructure spending -- increased by 2.9% year-on-year from January to November, investment in real estate development fell by 9.4% over the same period.

Xu Chenggang, a professor at Stanford's China Economic Research Center cited figures from Goldman Sachs estimating that China's debt currently stands at more than 300% of GDP, making it highly leveraged.

"When the leverage ratio gets too high, the risk of a financial crisis increases," Xu told Radio Free Asia's discussion show "Asia Wants to Talk."

Xu said the government is only staving off a financial crisis through top-down management of financial and real estate markets.

"If the market were allowed to operate [freely], a financial crisis would be very hard to avoid," he said. "They are avoiding bank collapses because most of the property sector is currently frozen and the market is inactive."

"If the market were allowed to operate, then deflation would be more clearly visible," Xu said.

He said that the government can turn to debt issuance instead, although ratings agency Moody's last week issued a downgrade warning on Chinese sovereign debt.

Chinese leaders agreed at the Central Economic Work Conference to run a budget deficit of 3% of gross domestic product in 2024, Reuters quoted three sources with knowledge of the matter as saying on Friday, adding that other fiscal support may be covered by off-budget debt.

Two of the sources told Reuters that special sovereign bonds could be issued to pay for extra expenditures as needed, with one saying they could amount to 1 trillion yuan (US$140 billion).

The government also announced plans to pump further cash into the economy, in a bid to send a more powerful stimulus message to investors after piecemeal approaches had left them disheartened, Bloomberg reported on Friday.

The central bank handed commercial lenders US$112 billion of one-year loans, helping to allay concerns over cash scarcity amid a surge in government debt issuance, the report said.

The move came after China's regulators told the country's biggest banks and asset managers to meet all “reasonable” funding needs from property firms, Bloomberg reported on Wednesday.

Translated with additional reporting by Luisetta Mudie. Edited by Malcolm Foster.