China has set a GDP target of 5% for this year, as it vowed to advance growth in stability while tackling “challenges” from the global economy and regional tensions that impede recovery.

Chinese Premier Li Qiang revealed moderate measures to rejuvenate the economy as he delivered his first government work report to nearly 3,000 of the country’s political elite at the opening of the National People’s Congress on Tuesday.

“We must persist in seeking progress while maintaining stability, promoting stability through advancement, and in construction before destruction,” said Li, China’s No. 2 official after President Xi Jinping.

This year’s targeted growth of “around 5%” is a slight dip from the 5.2% expansion recorded for 2023, potentially extending the record slow pace of economic expansion since 1990. China’s projection is a tad optimistic from the market consensus of 4%-4.6%. The International Monetary Fund predicts GDP to increase 4.6%

Based on historical performance, Alicia Garcia-Herrero, chief economist for Asia Pacific at Natixis, said the 5% is justifiable by a relatively higher average regional growth target at the provincial level. With the average provincial growth rate of 5.9% last year, China’s GDP achieved 5.2%.

“So this means that with this year’s 5.6% [regional growth target] – it’s come down – but there’s still room for them to target 5%. This doesn’t mean that it will be easy to get to 5%, but the point is that based on provincial data, this sounds reasonable.”

A budget deficit of 40.6 trillion yuan (US$5.64 trillion), or 3% of GDP, is predicted, representing an increase of 180 billion yuan. The gap narrowed from the 3.8% for 2023.

The government said it will also issue special long-term bonds for the next few years to fund “major strategic implementation and construction of major national security capabilities,” without specification. This year’s issuance will total 1 trillion yuan ($139 billion).

Structural reforms at medium-term costs?

The economic policy direction set out in Li’s work report matches market expectations that Beijing would resist pressure for stronger fiscal stimuli and instead focus on the longer-term to transform the world’s second-largest economy into a manufacturing and technological superpower.

“Currently, it is necessary to increase fiscal investment in many aspects. We must vigorously optimize the expenditure structure, strengthen the financial guarantee for major national strategic tasks and basic people’s livelihood, and strictly control general expenditures,” Li said.

He also urged provincial authorities to protect basic people’s livelihoods, wages and operations, as local governments are drowned in debt.

Urban unemployment is expected at around 5.5% with some 12 million urban jobs to be created this year. Youth unemployment is a pronounced problem underlining the fix policy makers face from demographic changes caused by a shrinking and aging population while productivity and overall growth are sputtering.

With an increasing number of university graduates entering the job market and China cracking down on real estate, education and technology industries that draw the youth, young people are finding it hard to find employment.

A spiraling real estate crisis, deflation amid overcapacity, and stock market volatility are caused by real structural problems, fundamentals which analysts at Atlantic Council’s GeoEconomics Center and Rhodium Group’s China Pathfinder project pointed out Beijing must address with “structural reforms.”

Not to mention that decades of reliance on exports and government investment models has made it difficult to fuel growth driven by domestic consumption, particularly at a time when investor confidence is waning. Falling housing and stock prices are evidence of that eroding confidence.

Li alluded to improving real estate policy and providing funding to deserving developers as part of accelerating a new development model for the industry without giving details. Real estate is one of the economy’s biggest growth drivers and troubles after a decades-long housing bubble burst a few years ago bringing ramifications to other sectors.

“Through the end of the year and start of 2024 Beijing continued to claim performance above the 2023 target of 5% GDP growth, despite a running battle to roll out extraordinary support measures including lifelines for property developers, mid-year expansion of the fiscal deficit ceiling, monetary policy easing and other steps, and unexplained distortions in the national accounts data,” wrote analysts Daniel Rosen and Rachel Lietzow in China Pathfinder’s February report.

“Long-term stability will still require urgent market reforms, and the present danger will be that recovery makes the pain associated with real reform harder to justify.”

To what length Chinese policymakers will go to root out the structural issues at the expense of shorter and medium-term gains remains to be seen.

Amid the deflationary climate, Li said consumer prices are this year targeted to rise 3%.

Diana Choyleva, founder and chief economist at Enodo Economics, said the Chinese leadership seems incapable of instituting the structural changes that would help it fuel a consumer-led recovery.

“As a dyed-in-the-wool socialist, Xi's approach to the economy leans heavily on the supply side, focusing more on production and distribution than on consumer demand.

“We have argued that Beijing’s focus on industrial policy and a supply side transformation, if successful, will only go so far and won't be enough to place the economy on a sustainable growth path.”

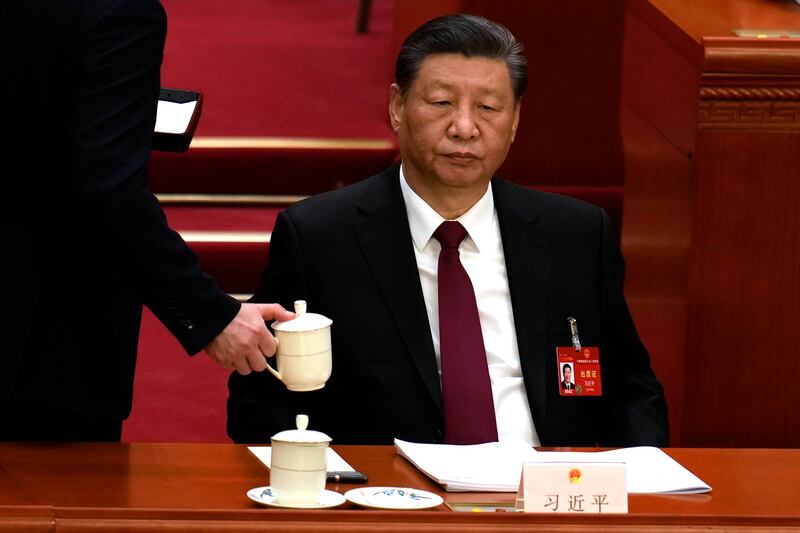

The Xi element

Li took more than 50 minutes to deliver his first work report, peppered with mentions of guidance from the ‘Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era’ now added to the constitution.

The ideology underpins Xi’s plan to build a ‘moderately prosperous society’ by rebalancing the economy and easing inequalities, and to carry out deep reforms of institutions. That is coupled with the ambitious development strategy of the Belt and Road Initiative introduced in 2013 that connects China with Asia and Europe through infrastructure investments and trade to realize the Chinese dream where China becomes a central global power.

A decade on, the costs of many of the projects have burdened governments where they are located, evoking opposition and worries of the unsettling extension of Chinese power.

Some said the current Chinese economic malaise is the result of political decisions and policy mistakes weighing on structural problems. Indeed, Xi’s “high-grade growth” model is rooted in his priorities of national security and upgrading technology to fuel buy-side consumption. He has called for a new wave of large-scale upgrades among Chinese firms, and also consumers who are being encouraged to trade-in old equipment such as cars and home appliances to boost domestic demand and raise the overall development threshold.

Li’s work report on Tuesday gave air time to advancing modernizing manufacturing transformation to boost the development of “new productive forces” that will eventually create more “Made in China” brands with international influence amid intensifying trade tensions.

The premier also highlighted a focus on tech sectors such as quantum computing and artificial intelligence where China’s competition with the United States is head on.

Defense spending for this year will total 1.67 trillion yuan, representing a similar 7.2% increase from the previous year。

On the issue of Taiwan, China adopted tougher language omitting mention of “peaceful reunification” to simply an “unswerving push to promote the great cause of reunification with the motherland.”

Edited by Mike Firn and Taejun Kang.