Investor confidence in China is at its lowest ebb in decades amid fears that the Counterespionage Law and other legislation could be used to target foreign companies, according to two reports from the European and American Chambers of Commerce and a high-ranking E.U. official.

While 2023 was supposed to be the year that investor confidence and optimism bounced back after years of restrictions under Chinese leader Xi Jinping's zero-COVID policy, but "the rebound has not materialized and business sentiment has continued to deteriorate," according to the AmCham’s annual review of U.S. businesses in China released this week.

Just 52% of companies said they are optimistic about doing business in China over the next five years, and "companies are shifting supply chains and redirecting investment away from China, " the report said, with many citing Sino-U.S. tensions and a flagging economy.

This was the lowest level of optimism reported since the AmCham Shanghai Annual China Business Report was first introduced in 1999, according to Reuters.

Some 40% of respondents are redirecting or planning to redirect investment originally planned for China, a 6-percentage-point uptick from last year, the report said, with Southeast Asia the most favored destination.

Meanwhile, “concern over future Chinese commercial policies" was a factor for 48% of the 325 companies who responded to the survey, the report said.

‘Legal uncertainties’

European Commission Vice President Vera Jourova said during a trip to Beijing this week that E.U. companies had told her that they “face many obstacles and legal uncertainties in China.”

“For China’s economic development, an attractive business environment with level playing field, fair conditions & transparency is crucial,” she said via her X account ahead of the High-Level Digital Dialogue with Chinese officials and companies on Tuesday.

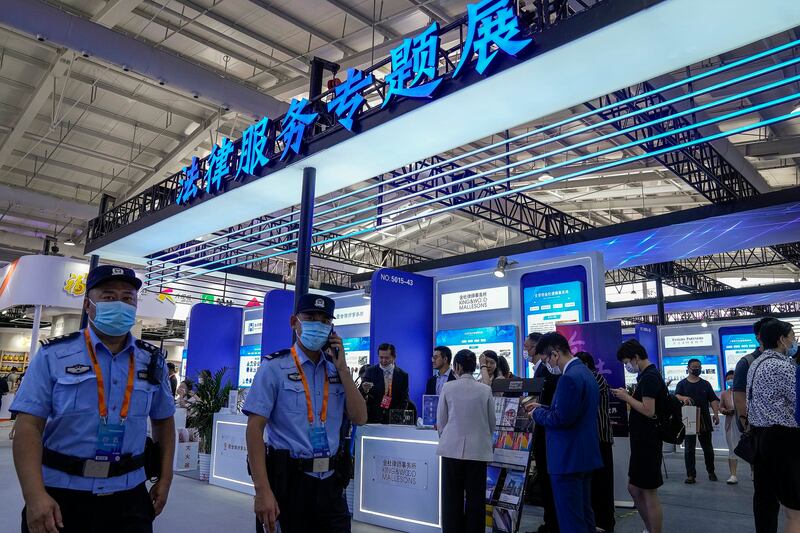

The European Chamber of Commerce had similar concerns in its Position Statement report published on Wednesday, citing uncertainty over how China will implement recent amendments to its Counterespionage Law, which came amid raids on foreign consultancy firms in China.

The newly amended law gives no definition of what constitutes a “state secret,” a matter of national security or the national interest, but expands the definition of espionage to cover cyberattacks against government departments or critical information infrastructure.

It also gives the authorities broader powers to access data and electronic equipment and to issue travel bans to individuals.

"The amended [Counter]espionage Law and the new Foreign Relations Law indicates an increasing focus on national security across a widening scope of areas, which is

prompting businesses to exercise even more caution," the European Chamber of Commerce report said.

European companies are "struggling" to understand their obligations under the new laws, it said.

"[This is] a factor that significantly decreases business confidence," the report said, citing the lack of definition of what exactly constitutes a "state secret."

"With no clear understanding of what kind of information can and cannot be obtained ... conducting business intelligence operations becomes a high-risk activity," the report said. "This enhances the attractiveness of other markets that can provide more legal certainty."

‘Buy China’

The AmCham report also cited patriotic "buy China" policies at state-owned enterprises and government agencies as a factor affecting business confidence.

"There are indications that “buy China” policies will soon apply to many more targets, potentially including the finance, energy and electricity areas which will be required to use only local software and hardware," the report said. "The ripples have already reached private Chinese firms, with many now opting to buy local products for reasons of political expediency."

"A majority, 56%, said there was favoritism toward local companies, nine percentage points higher than in 2020," it said, calling for a more predictable regulatory environment and fairer treatment for foreign companies.

European companies have also "reevaluated their basic assumptions about the Chinese market," the European Chamber of Commerce paper said. "The business community feels that predictability and reliability – core characteristics of China’s attractiveness as an investment destination – have been eroded as a result of erratic policy shifts."

"Several European companies are either considering shifting or have already shifted investments out of China to increase supply chain resilience, or have onshored supply

chains into China, detaching them from global value chains," the report said.

"What kind of relationship does China want to have with foreign enterprises?" E.U. Chamber of Commerce in China President Jens Eskelund asked in a letter introducing his chamber's report.

“Businesses need an answer as to whether China will focus on self-reliance and on tightening regulations on the basis of security concerns or whether the country intends to follow through on its market opening promises,” Eskelund said.

Future of the country

Germany-based international relations commentator Shi Ming said European companies are making it clear to the ruling Communist Party that they need to think realistically about their future in the country.

"These large European companies are no longer just talking – they have taken some very intensive measures and started to locate parts of their future [business] outside of China, or to withdraw from China altogether," Shi said. "European companies are saying very clearly ... that they are no longer obsessed with China."

He said the uncertainty over potential spying allegations was a big driver of this reaction, and that political considerations are now much more bound up with economic decision-making than before.

"Countries are now starting to react more strongly against China's Counterespionage Law [amendments] – Germany's Foreign Minister Annalena Baerbock called President Xi Jinping a 'dictator'," Shi said. "We haven't seen anything like that in Germany-China relations in 30 years."

Financial journalist He Jiangbing has already predicted a major shift in the way foreign companies manage their supply chains in the wake of the zero-COVID policy, and that the growing preoccupation with "national security" will hurt economic growth further.

"They're paying too much attention to security, which is very harmful to the economy," He said. "It's like the European Chamber of Commerce said, what exactly does ‘endangering national security’ mean?"

"[If they don't clarify], then this whole trumped-up [national security] charge thing will scare people away," he said.

Translated by Luisetta Mudie. Edited by Malcolm Foster.