Chinese stock markets have been on a roller coaster in recent days, surging on hopes of a massive fiscal stimulus package, but then plunging on disappointment after the measures announced Tuesday failed to live up to expectations.

The finance ministry is to announce further details on Saturday in a bid to stabilize markets in Shanghai and Hong Kong and boost growth, which has lagged in the world’s No. 2 economy.

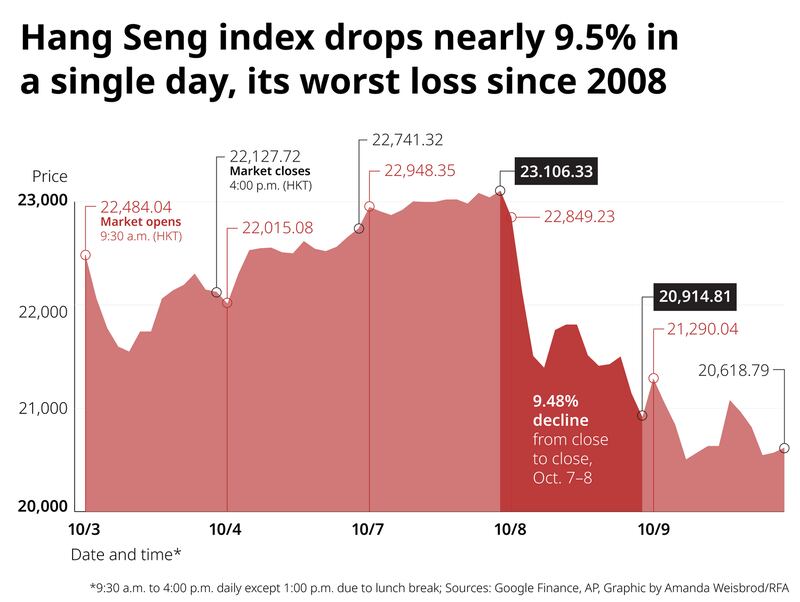

Hong Kong’s Hang Seng index had surged last week and on Monday – when mainland Chinese markets were closed for the National Day holidays – amid hopes that the government would roll out a big stimulus package similar to the one announced in 2008 by former Premier Wen Jiabao to cope with fallout from the global financial crisis, analysts told RFA Cantonese.

Wen was recently photographed sitting with President Xi Jinping, giving the impression that party elders were exerting pressure on Xi to bail out the economy from behind the scenes, according to Hong Kong-based veteran China commentator Ching Cheong.

"There were reports that many of the elders sent representatives to the recent Beidaihe [summer political] retreat, to put pressure on Xi Jinping," Ching said. "It looks as if the purpose of [the photo with Wen] is to create an atmosphere of harmony [among party factions]."

But then the Hang Seng index plunged 9.4% on Tuesday when the measures turned out to be long on rhetoric and short on details.

On Shanghai’s market, which opened Tuesday after being closed for a week, the benchmark Composite index fell 4.3% on Tuesday and a further 6.6% on Wednesday.

‘Like a pendulum’

In Tuesday’s press conference, National Development and Reform Commission Chairman Zhang Shanjie said the government would keep issuing ultra-long-term bonds to finance construction projects, and promised wide-ranging urbanization schemes to encourage more people to move to cities.

But equity analysts told Reuters that the markets know that only the Finance Ministry has the authority to make changes to the budgets, so the measures largely failed to impress.

"The market atmosphere is like a pendulum swinging from extremely pessimistic to extremely hot, with feverish increases that exceed the norm,” financial commentator Joseph Ngan wrote in a recent commentary for RFA Cantonese.

But he warned: "There are many risks hidden behind the short-term prosperity of the stock market, including market bubbles, sluggish consumer confidence and the weakness of the real economy."

As markets tumbled, the State Council Information Office said it would invite Minister of Finance Lan Fuan to speak Saturday – when markets are closed – about “promoting high-quality economic development."

Chu Cheng-chih, chairman of Taiwan's Marbo Investment Consulting, said much of Hong Kong's five-day rally last week was driven by foreign investment in a basket of mainland Chinese stocks following an earlier package of stimulus measures announced by Beijing on Sept. 24.

He said the fact that Hong Kong was trading while the rest of China was on vacation meant that the market had rallied sooner, and that now the correction had arrived.

"Buying momentum in mainland stocks has been coming to an end over the past couple of days," Chu said. "That consolidation is understandable and normal, and it's this that genuine investors should be paying attention to."

Translated by Luisetta Mudie. Edited by Luisetta Mudie and Malcolm Foster.