Indonesian President Joko “Jokowi” Widodo secured billions of dollars in investment commitments from Chinese companies during a two-day visit to China that wrapped up on Friday, his ministers said.

One of the biggest deals was an U.S. $11.5 billion commitment from one of the world’s largest glass makers, Xinyi, to build a manufacturing plant in Indonesia, said Investment Minister Bahlil Lahadalia, who accompanied Jokowi on the trip.

“This will be the second largest factory in the world after China,” the minister told a press conference, referring to Xinyi’s planned investment. “The output will be almost 95% for export because the market is overseas.”

If realized, Xinyi’s investment would create 35,000 jobs, Bahlil said.

Indonesia has a potential resource of 25 billion tons of quartz sand, the main raw material for making glass and solar panels, according to official data. And China is the world’s main producer of solar panels, with a 70% market share.

Bahlil said Xinyi had already invested $700 million in Indonesia last year to build a factory in Gresik, East Java.

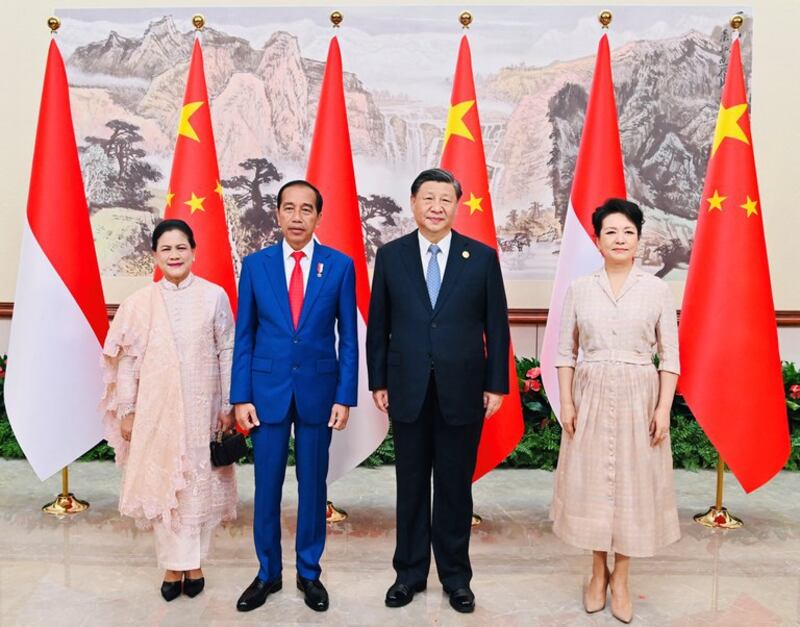

At a meeting on Thursday, Jokowi and Chinese President Xi Jinping focused on mutually beneficial economic cooperation, Indonesia’s top diplomat Retno Marsudi said.

During the visit to China, Jokowi sought more Chinese investment in renewable energy, health, food security and the construction of a new Indonesian capital city, Retno said.

In the health sector, Chinese businesses made investment pledges worth about $1.4 billion, she said.

China is Indonesia’s biggest trading partner and a major source of investment. Last year, Indonesia’s exports to China were recorded at $65.9 billion while imports were $67.7 billion, according to the Indonesian government’s statistics agency.

China was the second largest source of investment in Indonesia in 2022 with $8.2 billion, behind Singapore with $13.3 billion, according to data released by the Indonesian Investment Coordinating Board.

Market leader

Energy analysts welcomed the government’s move to sign investment deals with China for processing quartz sand.

“This is the right move because China is a market leader [in producing solar panels],” said Daymas Arangga, executive director of Energy Watch, an independent think-tank in Jakarta.

But he suggested the government also invite other countries, such as South Korea and Japan, to invest in the sector to prevent a price monopoly by China.

“The issue is that China controls the price. So other countries should also be offered to invest to maintain the market,” he told BenarNews.

Fahmy Radhi, an energy observer at Gajah Mada University in Yogyakarta, said Indonesia could boost its profits 10 times by processing quartz sand at home.

“This is a smart step to add value to the mineral, and we should support it,” he told BenarNews.

Fahmy noted that Indonesia, the world’s largest nickel producer, similarly added value to its nickel ore resources by boosting domestic processing.

Indonesia increased its profits from processing nickel, a key metal for making stainless steel and batteries, to $30 billion last year from $3.3 billion in 2018.

Indonesia banned raw nickel ore exports in 2020 to encourage the domestic smelting and refining industries. The country has also attracted investments from foreign companies – especially from China – to build battery factories in the country as part of its ambition to become a hub for electric vehicles.

‘Maintain peace, stability’ in region

Meanwhile in his meeting with Xi on Thursday, the Indonesian president called on major powers to manage their rivalries and avoid conflicts that could threaten Southeast Asia, Retno said on Friday.

“President Jokowi stressed that all countries, including China, must maintain peace, stability and prosperity in the region,” she said.

She said Jokowi also welcomed the resumption of communication between China and the United States, the world’s two largest economies and strategic rivals.

Tensions have been brewing between China and several Southeast Asian nations over overlapping maritime claims in the South China Sea, a strategic waterway that carries about a third of global trade.

Indonesia, while not a claimant to any of the disputed islands or reefs in the South China Sea, has repeatedly clashed with China over fishing rights and energy exploration near the Natuna Islands.

These islands lie within Indonesia’s exclusive economic zone but are also claimed by China under its sweeping “nine-dash line” map.

Indonesia has rejected China’s claim as having no legal basis.

Earlier this month, China and Southeast Asian nations agreed to speed up an agreement to prevent conflict in the South China Sea.

A code of conduct to prevent conflicts and promote cooperation in the disputed South China Sea has been under negotiation between China and the 10-nation Association of Southeast Asian Nations (ASEAN) since 2002, but progress has been slow.

BenarNews is an RFA-affiliated online news organization.