The U.S. semiconductor industry has said new prohibitions on microchip exports to China may be “overly broad” and harmful, after the Commerce Department on Tuesday expanded its rules to cover chips developed especially to skirt the existing export ban.

The rules were issued on Tuesday and both expand the number of high-end A.I.-capable chips subject to licensing requirements for export and force chipmakers to notify authorities before exporting any “gray zone” chips that fall just below the power threshold for bans.

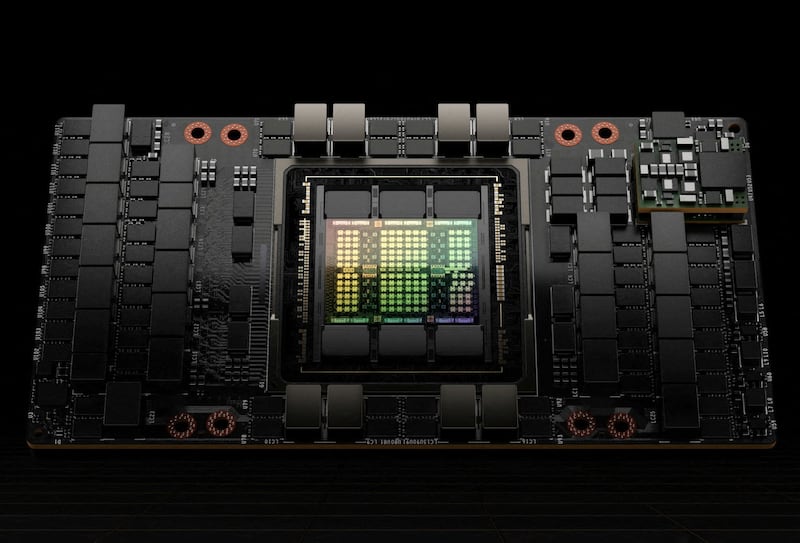

NVIDIA, the leading manufacturer of A.I.-capable chips in the United States, had after last year's initial ban on the export of advanced chips developed new chips that fell just beneath the export threshold.

But those chips – the A800 and H800, which are modified versions of the more powerful A100 and H100 chips made especially for the Chinese market – will now also be banned from sale to China.

NVIDIA's share price, which is up 268% since a year ago, fell 4.9% in morning trading after the new export restrictions were unveiled.

However, NVIDIA said in a statement it was not worried about the ban, which American officials say is needed to slow China's attempts to modernize its military to further its expansionist territorial goals.

“We comply with all applicable regulations while working to provide products that support thousands of applications across many different industries,” it said. “Given the demand worldwide for our products, we don’t expect a near-term meaningful impact on our financial results.”

Military purposes

Commerce Secretary Gina Raimondo told reporters the “vast majority” of chips exported to China would remain unaffected by the new rules. Most chips used for consumer goods and electronics continue to flow to China, she said, just not those with clear military purposes.

“These export controls are intended to protect technologies that have clear national security or human rights implications,” Raimondo said, noting China would continue to import “billions of dollars” of chips.

Gregory Allen, an expert on A.I. chips at the Center for Strategic and International Studies, said the new rules would have a significant effect on China’s tech sector by cutting off even NVIDIA’s less-powerful chips, which were still more powerful than any current alternatives.

“The updated controls will specifically prohibit exports of the AI chips that U.S. companies modified in order to comply with earlier controls,” Allen told Radio Free Asia. “The updated controls will significantly restrict China's access to advanced AI chips.”

Still there remains concerns about creating a market void.

The Semiconductor Industry Association, which claims to represent “99% of the U.S. semiconductor industry by revenue,” said in a statement the group was evaluating the new prohibitions but was worried China will turn to other countries for similar chips.

U.S. officials have closely courted both Japan and the Netherlands – two of the only other countries in the world with industries capable of making the finely-etched chips needed for A.I. chips – to follow suit and ban their companies from exporting military-grade chips to China.

The association said it recognized the national security concerns but that little would be achieved if there was not global cooperation.

“Overly broad, unilateral controls risk harming the U.S. semiconductor ecosystem without advancing national security as they encourage overseas customers to look elsewhere,” it said, calling for “coordination with allies to ensure a level playing field for all companies.”

Chip war

The rules are only the latest in the ongoing battle over global trade in chips, which has also seen Beijing ban U.S. chipmaker Micron from selling in its market and the Biden administration lay down $52.7 billion in subsidies to coax manufacturers back to the United States.

The ban, though, failed to stem Chinese chipmaker SMIC from developing an advanced 7-nanometer chip used in a new flagship phone from Huawei that was released in China last month, with U.S. lawmakers calling for an investigation into how SMIC developed the capability.

Beijing has repeatedly slammed U.S. export bans and subsidies for its chipmakers as protectionist moves and part of a “Cold War mentality,” and said that the restrictions are creating havoc in world markets.

“We have made our position clear on U.S. restrictions of chip exports to China,” Foreign Ministry spokesperson Mao Ning said on Monday, responding to a question about rumors of the impending new ban. “The U.S. needs to stop politicizing and weaponizing trade and tech issues and stop destabilizing global industrial and supply chains.”