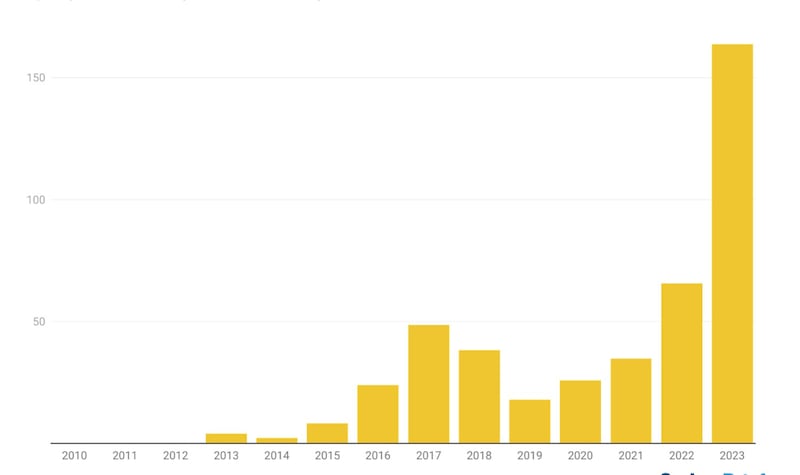

China’s clean energy sector saw an unprecedented surge in 2023, injecting a staggering 11.4 trillion yuan (US$1.6 trillion), almost a third more than the previous year, into the nation’s economy, new analysis by a nonprofit think tank has shown.

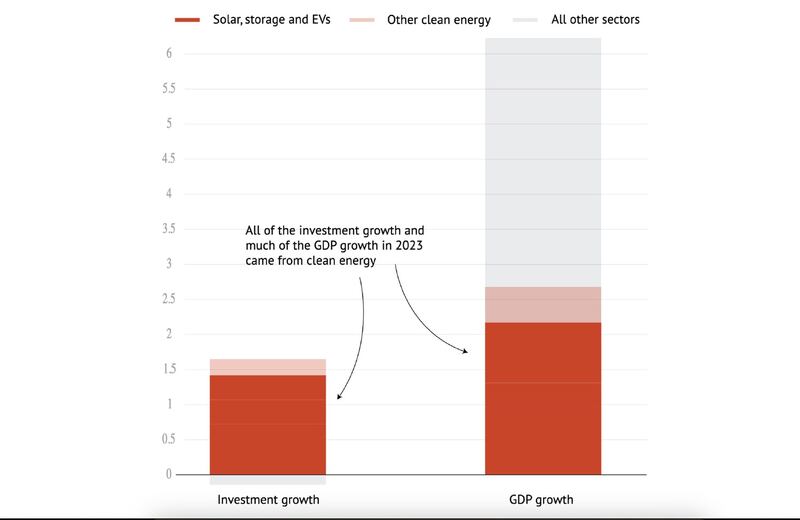

This green energy boom accounted for the entire investment growth and eclipsed all other sectors in driving the country's economic expansion, according to the sector analysis by the Helsinki-based Centre for Research on Energy and Clean Air (CREA).

It was first published Thursday on Carbon Brief, a website that posts news and policy analysis on climate and energy.

“In 2023, China’s GDP was reported at 126 trillion yuan ($17.8 trillion), so the clean energy sectors contributed 9% of the total,” Lauri Myllyvirta, CREA’s lead analyst and the author of the analysis, told Radio Free Asia.

China’s GDP saw a 5.2% increase last year, surpassing the government’s target. However, without the boost from clean-energy sectors, growth would have been approximately 3%, he said.

“This would have missed government growth targets at a time of increasing concerns over the nation’s economic prospects amid the ongoing real-estate crisis and declining population,” CREA said in its analysis.

The investment surge was in what the Chinese officials and state media call the “new three” industries: solar power, electric vehicles and batteries, the focus of Beijing’s clean-energy investments in 2023.

China, the world’s largest emitter, dominates the global market in these key green technologies, with over 80% of solar exports, half of lithium-ion battery production, and above 20% of electric vehicle manufacturing.

Clean energy investment rise eclipses real estate drop

The clean energy sector as a whole was “the largest driver of China’s economic growth overall, accounting for 40% of the expansion of GDP in 2023,” CREA said.

Investment in the sector soared by two-fifths in a year to 6.3 trillion yuan ($887 billion) in 2023, matching the total global investment in fossil fuels and equating to the GDP of Switzerland or Turkey.

Solar led most of it, with its value soaring 63% to 2.5 trillion yuan. Electric vehicle production reached 9.6 million units, a third of all vehicles produced in the country, according to CREA.

“China’s total investment in fixed assets was reported by the National Bureau of Statistics at 50 trillion yuan ($7.1 trillion) in 2023. Investment in clean energy industries made up 13% of the total,” Myllyvirta told RFA.

In 2023, total investment rose by 3% despite a consecutive annual decline in real estate investment, which dropped by 9.4% from January to November.

“The net increase came entirely from investment in clean energy industries, so in that sense, clean energy made up for the fall in real estate,” he said.

Experts say the shift elevates the clean-energy sector to a crucial role in China’s energy and climate initiatives and broader economic and industrial strategies.

Despite the boom in clean energy, experts say integrating all the new renewables into the existing power system and managing the electric grid more efficiently pose a severe challenge in China.

Another key challenge is “rationalizing and consolidating those manufacturing sectors where overcapacity is starting to build up because of the major wave of investment,” Myllyvirta told RFA.

Coal is still king and the biggest problem

According to the International Energy Agency, global coal use in 2023 hit a record high, surpassing 8.5 billion tons for the first time.

As the dirtiest and most significant greenhouse gas emitters, tackling coal is crucial for significantly reducing global carbon emissions and combating climate change.

In China, coal still provides 65% of electricity and more than half of the world’s coal-fired generation occurs in China.

As the country’s electricity demand increased amid the heat wave and post-COVID rebound, thermal power generation came to the rescue since hydropower struggled due to drought.

“China’s energy strategy at the moment is definitely 'all of the above,' with a lot of investment in coal mining, coal-fired power, domestic oil, and gas production, as well as clean energy,” Myllyvirta said.

“However, in terms of investment volumes, clean energy trumps fossil fuels.”

He added that the total investment in coal-fired power plants in 2023 was 90 billion yuan ($13 billion), while investment in clean power generation was more than eight times larger.

Myllyvirta said the country has to go from investing in new coal power plants to dismantling existing ones to meet climate goals.

“The reason for my optimism is that maintaining the current level of investment in clean energy will ensure that the use of coal and other fossil fuels begins to fall,” he said.

Edited by Mike Firn and Elaine Chan.