UPDATED AT 05:02 a.m. ET on 2023-05026

Global solar investment is projected to outpace oil spending for the first time in 2023, with China leading the way, a report by an energy watchdog said.

An estimated U.S.$400 billion will be allocated to solar energy this year, the International Energy Agency (IEA) said Thursday in its annual world energy investment report.

“About $2.8 trillion is set to be invested globally in energy in 2023, of which more than $1.7 trillion is expected to go to clean technologies -- including renewables, electric vehicles, nuclear power, grids, storage, low-emissions fuels, efficiency improvements and heat pumps,” the Paris-based agency reported.

Clean energy investment surpasses the estimated $1 trillion allocated to fossil fuels, which includes coal, gas and oil. In the past, the $2 trillion annual energy investment was evenly divided between fossil fuels and clean technologies.

China, in particular, has witnessed an exponential acceleration in its solar sector, with installations during the first four months of this year already tripling the figures recorded during the same period in 2022, which marked a twofold increase compared to the previous year.

China alone added over 100 gigawatts (100 billion watts) of solar PV capacity in 2022, almost 70% higher than in 2021.

The report said this robust growth in China’s solar industry is contributing significantly to the world’s progress toward achieving net-zero targets.

According to China Electric Power News, citing the National Energy Administration, China's combined wind and solar power capacity reached 820 gigawatts (GW) as of end of April, constituting 31% of the nation's total installed power generation capacity, with wind power accounting for 14% and solar power for 17%.

The state-run industry newspaper reported that between January and April, the newly installed wind and solar capacity amounted to 63 GW, representing 74% of the country's new installations. This figure marks an 11.5 percentage point increase compared to the previous year.

“Clean energy is moving fast -- faster than many people realize. This is clear in the investment trends, where clean technologies are pulling away from fossil fuels,” said Fatih Birol, IEA’s executive director.

“For every dollar invested in fossil fuels, about $1.7 is now going into clean energy. Five years ago, this ratio was one-to-one.”

The report attributed the surge in clean energy investment to various factors, including volatile fossil fuel prices, the implementation of inflation-related policies in the United States, Europe, Japan and China, and growing concerns over energy security arising from Russia’s invasion of Ukraine.

However, the IEA report also cautioned that Russian action has simultaneously prompted increased investment in upstream oil and gas sectors, with a 7% rise predicted in such investments in 2023, marking a return to levels last seen in 2019.

“The few oil companies that are investing more than before the COVID-19 pandemic are mostly large national oil companies in the Middle East,” the IEA said.

The report said renewable energy investment is expected to have increased 24% since 2021, while fossil fuel investment saw a more modest rise of 15%.

Meanwhile, global coal demand reached an all-time high in 2022, partially due to record-breaking gas prices, with 40 gigawatts of new coal plants approved – the highest figure since 2016. Almost all of these were in China.

Investment in coal supply is expected to rise by 10% in 2023, nearly six times higher than the levels aligned with the global 2030 climate targets.

China’s love for coal shows “high political priority attached to energy security after severe electricity market strains in 2021 and 2022, even as China deploys a range of low-emission technologies at scale,” the report said.

One critical obstacle impeding the expansion of renewable energy sources is the challenge of connecting projects to electricity grids, the report said.

This barrier remains the most significant hurdle in furthering the adoption and integration of renewable energy into existing power systems, the IEA said.

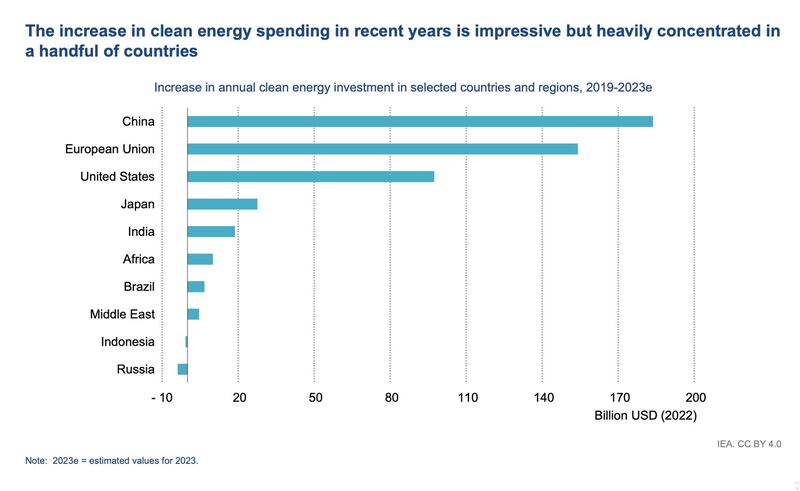

Also, more than 90% of the increase in clean energy investment is in advanced economies and China, which presents a severe risk of a new divide globally if the clean transitions do not pick up in developing and middle-income countries.

However, the IEA said there were some encouraging solar investments in India and renewables in Brazil and parts of the Middle East.

Edited by Mike Firn.

Updated to add data on China's wind and solar capacity.