China’s “extraordinary” acceleration in renewable energy capacity propelled 2023 to witness the fastest global growth rate in over twenty years, the International Energy Agency (IEA) said in a new report on Thursday.

The world's annual additions to renewable electricity generation capacity soared by nearly 50%, reaching approximately 510 gigawatts (GW) - marking the 22nd consecutive year of setting new records in renewable capacity growth, the Paris-based IEA said in its Renewables 2023 report.

According to the report, China’s deployment of solar PV (photovoltaic) in 2023 increased by 116%, matching the global total of 2022, while its wind power installations increased by 66% compared to the previous year.

The report predicted that the next five years will see the fastest growth yet, but warned the lack of financing for emerging and developing economies is a vital issue.

The current expansion of renewable power has made the COP28 goal of tripling global capacity to at least 11,000 GW by 2030, which more than 130 governments agreed to during the climate change conference last month in Dubai.

China, India, and Indonesia did not join the pledge due to its accompanying anti-coal stance and the more demanding goal of doubling the average annual rate of energy efficiency improvements to 4%.

“Onshore wind and solar PV are cheaper today than new fossil fuel plants almost everywhere and cheaper than existing fossil fuel plants in most countries,” IEA’s executive director Fatih Birol said.

“For me, the most important challenge for the international community is rapidly scaling up financing and deployment of renewables in most emerging and developing economies, many of which are being left behind in the new energy economy.”

“Success in meeting the tripling goal will hinge on this.”

Under existing policies and market conditions, global renewable power capacity is expected to grow to 7,300 GW by 2028, with renewables overtaking coal to become the largest source of global electricity generation by early 2025, according to IEA projection.

The growth trajectory is about 2.5 times its current level, which is still short of the tripling goal by 2030.

Asia-Pacific progress report

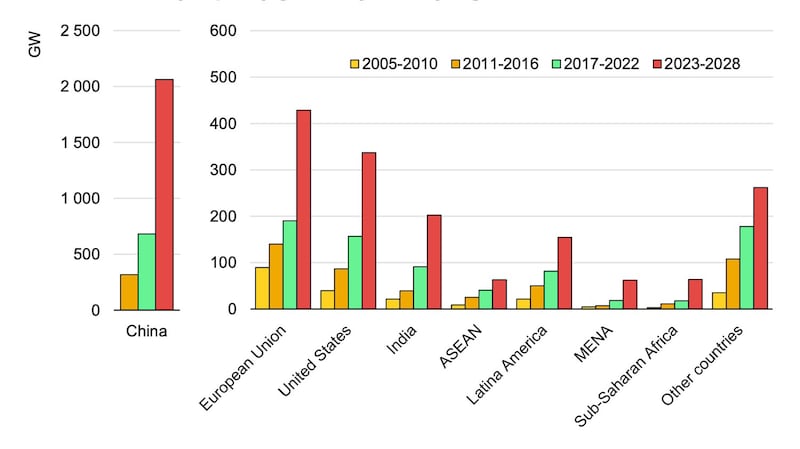

The world’s second-biggest economy, China, has a renewable energy capacity to triple the previous five years’ increase of 2,000 GW in the next five years, making up 56% of the global increase, IEA said.

From 2023 to 2028, China will add almost four times more renewable capacity than the European Union and five times more than the US, the second and third-largest growth market.

According to IEA’s forecast, the world’s renewables “powerhouse” is expected to reach its national 2030 target for wind and solar PV installations - 1,200 GW - this year, six years ahead of schedule.

By 2028, almost half of China’s electricity generation will come from renewable energy sources.

Apart from China, the rest of Asia will see renewable capacity grow by 430 GW by 2028, a 73% increase from 2022 levels, with India driving half of the regional growth and ASEAN adding 14%.

India is projected to add 205 GW by 2028, doubling its 2022 capacity, and is poised to become the third-largest global market for renewables.

The 10-member Association of Southeast Asian Nations (ASEAN) is expected to increase renewable capacity by a combined 63 GW by 2028, IEA said.

Southeast Asia has the potential to offer one of the highest global renewable growth possibilities, the IEA said, but would require “more ambitious renewable energy targets and prompt implementation of long-term, transparent, and competitive support policies.”

In major Southeast Asian economies such as Indonesia, Vietnam, and Thailand, regulations and policy support gaps hinder renewable energy growth and project development.

The overcapacity of young, contract-bound fossil fuel power plants, particularly coal and gas, impedes the transition to renewable energy by financially disincentivizing utilities from investing in new renewable projects.

Vietnam’s rapid solar PV boom, with installations reaching 20 GW in 2019-2020, has led to challenges in integration, with a pressing need for more investment in transmission and distribution infrastructure.

Last year, Vietnam and Indonesia signed into the Just Energy Transition Programme in a shift towards reassessing and potentially retiring older conventional plants, aided by international financial support to alleviate government budget pressures.

Edited by Mike Firn and Taejun Kang.