Indonesia is throwing open its doors to Silicon Valley, offering a digital gold rush for titans of the U.S. big-tech industry eager to tap into a burgeoning market of more than 270 million consumers.

The sprawling archipelago nation is fast becoming a strategic battleground in Southeast Asia for dominance in big technology.

During the past month Apple CEO Tim Cook, Microsoft’s Satya Nadella, and SpaceX and Tesla boss Elon Musk have all jetted into Indonesia and met separately with President Joko “Jokowi” Widodo to discuss multibillion-dollar investments in manufacturing, artificial intelligence, cloud computing, and even Starlink, Musk’s satellite-based internet service.

The Indonesian government has made digitalization a top priority, launching initiatives to improve internet connectivity, promote e-commerce, and foster a thriving startup ecosystem.

“Indonesia is currently undergoing an accelerated national digital transformation and opening up many investment potentials,” Jokowi said during his meeting with Musk on the sidelines of the World Water Forum in Bali on Monday.

“Hence, we value and actively promote the investment endeavors of companies like SpaceX, Tesla, Neuralink, and Boring in Indonesia,” the president said, referring to Musk’s various business ventures.

The flurry of activity comes as Indonesia, the largest Southeast Asian economy, seeks to position itself as a major player in the global tech landscape.

China has already made inroads through big-ticket investments in Indonesian heavy infrastructure, and Chinese tech giant Huawei also has a footprint here.

For U.S. tech companies, Indonesia represents a tantalizing opportunity to expand beyond saturated markets and tap into a region with immense growth potential.

The country's digital economy is projected to reach U.S. $124 billion by 2025, fueled by rising internet penetration, a growing middle class, and a booming e-commerce sector, according to a study by Google, Temasek, and Bain & Company.

In its ambitious bid to become a global hub for electric vehicle (EV) manufacturing, Indonesia has actively sought investment from Tesla. The country, rich in nickel ore reserves, aims to leverage this resource for EV battery production and, eventually, full-scale manufacturing of electric cars.

The country’s strategic location and abundant natural resources make it an attractive destination for investors eyeing the growing EV market, according to analysts.

Indonesia’s vision aligns with its ban on raw nickel exports, encouraging investors to refine nickel within Indonesian smelters, in which the Chinese have invested heavily, analysts say. By doing so, the nation hopes to boost manufacturing of batteries for electric cars and attract foreign investment in related sectors.

Jokowi's administration has been actively courting Musk and Tesla for years, though with little success. That included a May 2022 visit that Jokowi paid to Musk at the SpaceX launch site in Texas.

Hours after Musk arrived in Bali over the weekend, he launched the Starlink service, aiming to improve internet connectivity in remote areas of the archipelago.

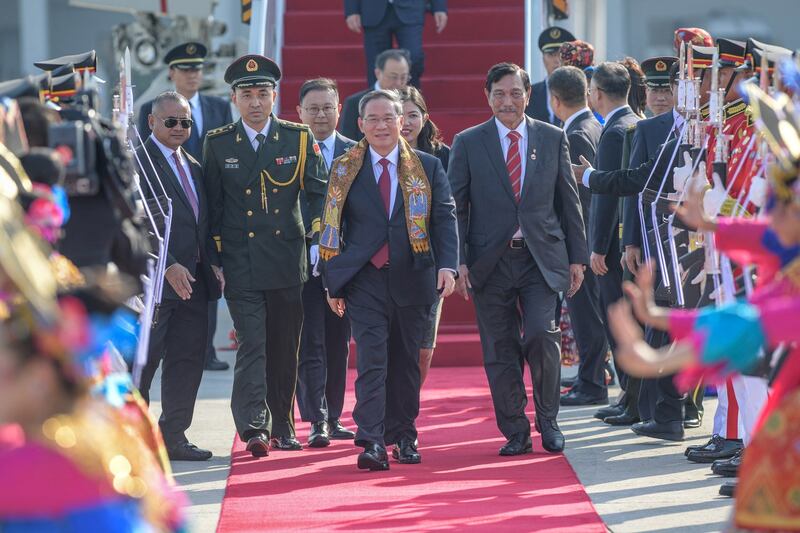

In Bali, Luhut Pandjaitan, Indonesia’s coordinating minister for maritime affairs and investment, said Musk would consider an offer to establish an EV battery plant in Indonesia.

Late last month, Microsoft's Nadella announced an investment of $1.7 billion over the next four years to bolster Indonesia's digital landscape, along with AI skills training opportunities for 840,000 people and support for the nation's growing developer community.

That represents the single largest investment in Microsoft’s 29-year history of doing business in the country.

“Together, these initiatives will help achieve the Indonesian government’s Golden Indonesia 2045 Vision, which aims to transform the nation into a global economic powerhouse,” Microsoft said in a blog post.

Earlier in April, Cook said Apple would “look at” manufacturing in Indonesia after he met Jokowi at the presidential palace in Jakarta.

By courting Western investment, Jakarta is diversifying its economic partnerships and reducing its reliance on China, which has poured billions of dollars into infrastructure projects, mining operations, and manufacturing, analysts say.

‘Friends with everyone’

In recent years, Chinese firms have built roads, railways, and power plants across the archipelago, boosting connectivity and economic development thanks to Beijing's Belt and Road Initiative.

However, the Indonesian government has also emphasized the importance of diversifying Indonesia’s economic partners and attracting investment from other countries.

“Both China and the U.S. are welcome to invest, but they must commit to realizing their investments, not just using Indonesia as a market,” said Heru Sutadi, executive director of the Information and Communication Technology Institute in Jakarta.

“Indonesia is friends with everyone. It’s not interested in geopolitical games, including geoeconomic ones,” he told BenarNews.

Amid a trade war between China and the United States, Southeast Asian countries like Indonesia and Malaysia have emerged as beneficiaries of the “China Plus One” strategy, in which companies diversify production outside China.

“This is an opportunity for Indonesia to question these companies about their investment plans,” Heru said.

But the influx of investment from American technology firms also raises concerns about Indonesia’s readiness.

While the country boasts a young and tech-savvy population, its infrastructure remains underdeveloped and its regulatory framework for the digital economy is still evolving, analysts said.

Experts emphasize the need for Indonesia to invest heavily in education and skills training to ensure its workforce can compete in the global tech market. They are calling for greater regulatory clarity and consistency to attract and retain foreign investment.

“We haven’t attracted much investment due to the lack of a robust tech ecosystem, including infrastructure, regulations, and skilled labor,” said Tauhid Ahmad, a senior economist at the Institute for Development of Economics and Finance in Jakarta.

Tauhid pointed to Tesla’s decision to put off investment in Indonesia, citing the lack of a local supply chain for electric vehicle batteries as an example.

He also said that U.S. companies tended to be more cautious than Chinese firms, focusing on the broader Southeast Asian market rather than solely on Indonesia.

Despite these challenges, Tauhid said, he was optimistic about Indonesia’s potential.

“We have a stable GDP, a large population, and high consumption levels,” he said.

“To realize this potential, we need to invest in infrastructure and develop a skilled workforce.”

He suggested the government create a technology academy modeled after Apple’s to nurture local talent.

“We need to do more than just train a few people at the Apple Academy,” he said. “We need a large pool of skilled workers ready to meet the demands of the tech industry.”

Suzie Sudarman, an international relations lecturer at the University of Indonesia, however questioned the motivations behind the visits by the top U.S. executives.

“These individuals are not long-term investors,” Suzie told BenarNews.

She pointed to Apple’s minimal presence in the country, having only invested $98.5 million to establish its Apple Develop Academy in three Indonesian cities.

“If they were to invest, clarity is essential, assurances that their investments will yield returns.”

“Unfortunately, corruption permeates our governance,” she said. “Hence, our country has become a refuge for fly-by-night entrepreneurs.”